tax loss harvesting limit

Generally those losses can then offset any capital gains from. Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way.

Everything You Need To Know About Tax Loss Harvesting Fundx Insights

Taxpayers can often use tax-loss harvesting to lower their tax burden by selling their investments at a loss.

.jpg)

. Even if you dont have any capital gains to offset any investment losses in the current tax year could still reduce your taxable income by up to 3000. An investment was originally purchased for 20000 but is now down 25 to 15000. Thomas earns 120000 a year and is in the 24 tax bracket for both ordinary income and short-term capital gains.

While theres no limit to the amount of crypto you can sell or trade there is a strict limit for a capital loss offset. Does a Limit Exist to Crypto Tax-Loss Harvesting. Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct.

There are some rules to. Lets break down how it works. However there is no such grace period for tax-loss harvesting.

So set that egg. Simply put you cant. So if you have a 4000 gain and a 1000 loss youd.

Help your clients save on their tax bill through tax loss harvesting. Put simply tax loss harvesting is the act of selling a losing position to gain the benefit of a possible tax deduction and using the proceeds to move into another asset at a. Know the Limits of Account-Level Tax Loss Harvesting September 2 2021 By Steve Zuschin Most advisors face the same conundrum.

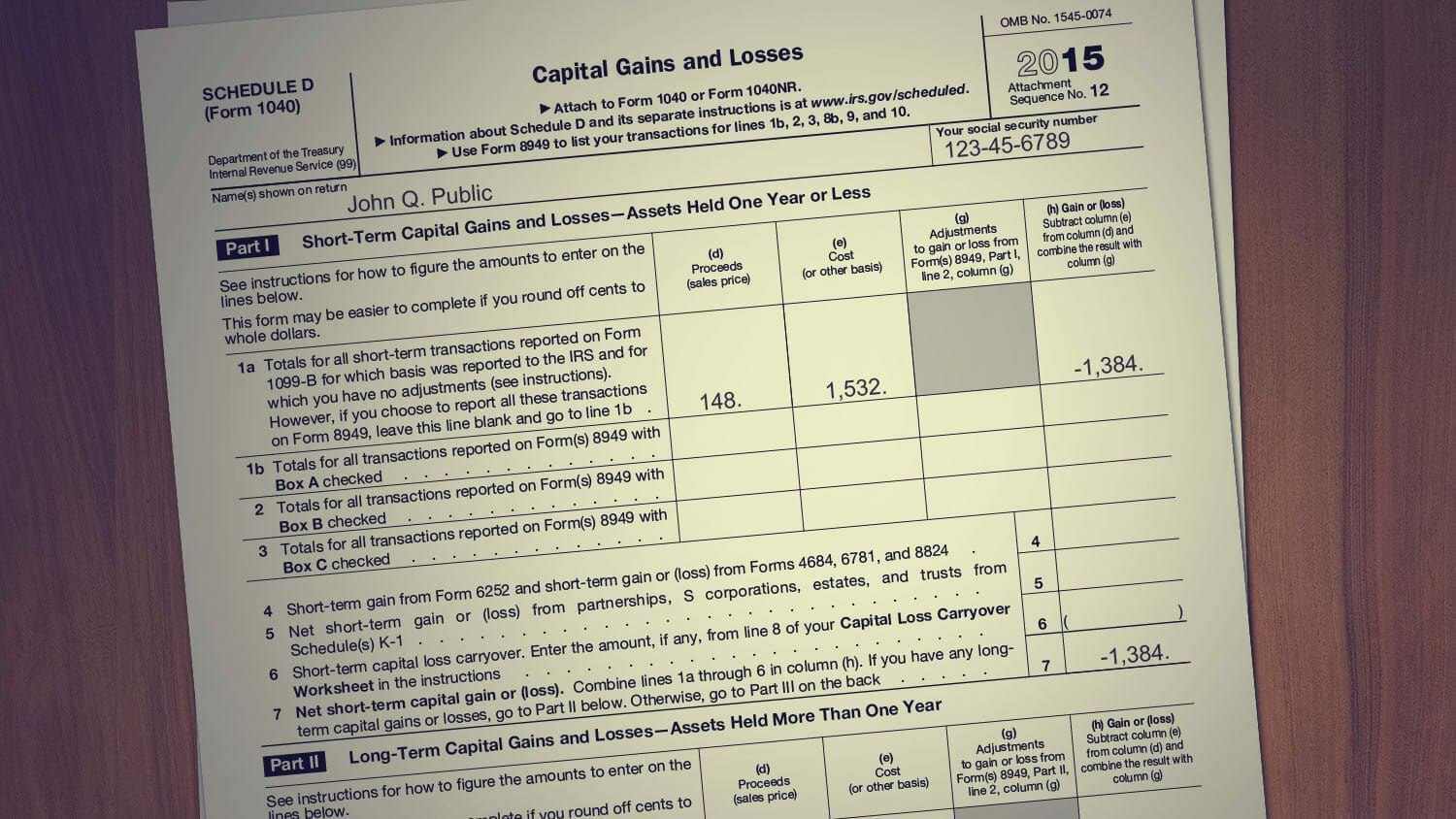

Tax loss harvesting involves selling a losing investment in order to generate capital losses that you can write off on your tax return. The current tax rules allow you to use capital. Harvesting generates a 5000 capital loss.

In this example Rachel generated a 1000 capital loss that she can use to offset other gains or potentially increase her tax refund come Year 1 tax season. Assuming that there are current capital gains to offset that. Currently the amount of excess losses you can claim as a deduction is.

When used strategically tax gain harvesting can save money reduce taxes and lower your portfolios risk. Clients have multiple accounts with. You need to complete all of your harvesting before the end of the calendar year Dec.

You can still only write off up to 3000 of stock losses so if you exceed that for the following year carry the loss over to subsequent years until you use up your total losses. Menu burger Close thin Facebook. Remember we can use tax loss harvesting to offset income up to 3000 per year so Patrick can book that 5000 loss reduce his taxable income for the year by 3000 and.

Your 25000 loss would offset the full 20000 gain from Investment A meaning youd owe no taxes on the gain and you could use the remaining 5000 loss to offset 3000.

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting Opportunity For Fiscal Year Fy 2021 22 Z Connect By Zerodha Z Connect By Zerodha

How To Use Tax Loss Harvesting To Boost Your Portfolio

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

What Is Tax Harvesting What Is Tax Loss Harvesting Tax Harvesting In Mutual Funds Youtube

Tax Loss Harvesting Guide 2022 Beat Capital Gains

Turning Losses Into Tax Advantages

Tax Loss Harvesting Napkin Finance

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker

Crypto Tax Loss Harvesting Investor S Guide Koinly

Crypto Tax Loss Harvesting Investor S Guide Koinly

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting And Wash Sale Rules

Tax Loss Harvesting John Hancock Investment Management

A Detailed Review Of Betterment Returns Features And How It Works